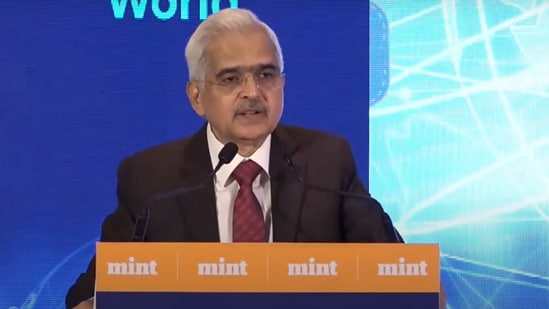

Reserve Bank of India (RBI) governor Shaktikanta Das on Thursday delivered a keynote address at the Mint BFSI Summit in Mumbai.

Here are the top quotes of the RBI governor from the banking, financial services and insurance summit.

• All key indicators of scheduled commercial banks (SCBs), namely, capital adequacy, asset quality, and profitability have shown improvement in the last four years… The Indian financial sector has emerged better than when we entered the period of massive difficulties. On the whole, India’s banking sector has emerged stronger in the unprecedented challenges. How was this achieved? All the good work by all the stakeholders.

• In the aftermath of the Infrastructure Leasing and Financial Services (IL&FS) crisis, the Reserve Bank heightened its focus on maintaining and fostering macro-financial stability through a series of conventional and non-conventional measures. The flexibility provided in the Flexible Inflation Targeting (FIT) framework of maintaining price stability, while keeping in mind the objective of growth, helped us to accommodate large supply-side shocks while focusing on immediate growth concerns during the pandemic.

• I would not look at UPI as a monopoly. The success of UPI in a large measure also owes a lot to the private sector payment players. The private sector companies have had a major role. UPI is perhaps the best in the world and should become a world leader, he said.

• In the recent period, the Reserve Bank has undertaken a complete overhaul of the regulatory architecture of the banking system. These regulatory steps include, among other things, the implementation of leverage ratio (June 2019; large exposures framework (June 2019); guidelines on appointment of directors and constitution of committees of the board (April 2021); revised guidelines on securitisation of standard assets and transfer of loan exposures.

• Post-pandemic digital lending has seen an exponential rise in various emerging economies including India. There has been an increase in the scale and velocity of digital credit. At the same time, it has raised a host of business conduct issues.

• The RBI’s position on cryptocurrency remains unchanged. Travelling down that path will create huge risks. I don’t think the world or emerging markets (EMs) can take a crypto mania like the Tulip mania.

• We are expanding wholesale CBDC and exploring the potential for programmable features in retail CBDC to enable senders to define specific end uses.