The Reserve Bank of India on Thursday released the minutes of the meeting of Monetary Police Committee (MPC) that took place between February 6 to 8. The MPC had announced the decision to keep the policy rates unchanged at 6.5 per cent.

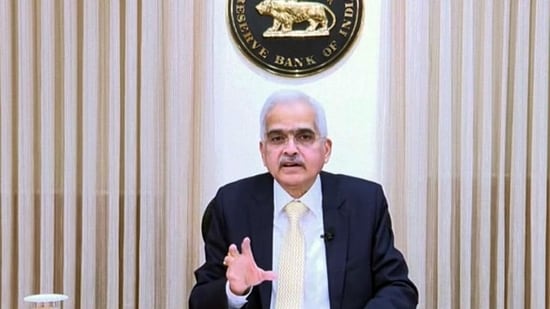

During the meeting, RBI governor Shaktikanta Das explained why was the decision taken.

“The current setting of monetary policy is moving in the right direction, with growth holding firm and inflation trending down to the target. At this juncture, monetary policy must remain vigilant and not assume that our job on the inflation front is over,” Das was quoted as saying during the meet as per the minutes.

“We must remain committed to successfully navigating the ‘last mile’ of disinflation which can be sticky. As markets are front-running central banks in anticipation of policy pivots, any premature move may undermine the success achieved so far. Price and financial stability are essential to sustain a long haul of high growth,” Das added.

“Policy imperative at the current juncture is to remain focused on achieving the 4 per cent inflation target on a durable basis, keeping in mind the objective of growth. Accordingly, I vote to keep the policy repo rate unchanged and continue with the focus on withdrawal of accommodation,” the central bank governor said.

ALSO READ: RBI Bulletin: Indian economy continues to sustain momentum of first half of FY24

As per the RBI MPC meeting minutes. Das said that the real GDP in this fiscal, on top of a growth of 7.2 per cent recorded in 2022-23.

“Inflation is edging down and is expected to soften to 5.4 per cent in 2023-24 from 6.7 per cent in the previous year (average for the year),” Das added.

While stating that the consumer confidence is rising, business sentiments remain upbeat and inflation expectations are getting steadily anchored, the governor said that the CPI inflation has fallen decisively from the heightened levels of last summer.